What is a Merchant ID Number & How to Find Yours

This article was published on August 8, 2019, and updated on April 5, 2023.

Your Merchant ID number (also known as a MID) is extremely important. It’s a number that is completely unique to your business. And it’s another number that you have to keep track of as if you didn’t already have 50 other things on your mind at all times. Wasn’t running a business supposed to be a dream come true? Elon Musk, now the richest man in the world (take that Jeff Besoz) once said: “Creating a company is a very difficult thing. A friend of mine has a saying: ‘Starting a company is like eating glass and staring into the abyss.’ You have to do lots of things you don’t like.” [1]

Well remembering your merchant ID number is just one more of those tasks.

What is a Merchant Identification Number or MID?

A Merchant Identification number is a unique code assigned to merchants by their acquiring bank or, simply speaking, the payment processor. This merchant ID number is a must-have for the identification of a merchant in processing networks.

Why is your merchant ID number important?

- Because your MID is mandatory for channeling transactions through the appropriate routes and ensuring that the money reaches the right destination.

- Because the MID is essentially when identifying a merchant during communication with his or her money processor and other parties.

- The MID number ensures that payments reach their destinations without any problems.

Each online merchant gets his or her merchant identification number or MID for debit or credit card processing. This code is transferred along with cardholder information to all the stakeholders involved in an e-transaction. The

Processing card payments is a part and parcel of your daily business operations. However, besides processing payments you should also be acquainted with how to make your transaction safe and secure. This is where a MID comes into play. Merchant ID ensures payments reach their destination without any problems.

When a merchant opens an account with an acquiring bank, he or she gets a Merchant Identification Number (MID). But before getting a merchant ID, he or she will need to verify his or her business. This verification involves documentation such as names of the principal owners, Taxpayer Identification Number, and other relevant data.

What if you don’t have a merchant ID?

All companies are given an MID but their acquiring bank. However, you do not require a MID if you are using an e-wallet service like Square and PayPal to process your payments, as you do not need a formal merchant account to use them.

But consider the risk. There is a downside to using these payment processors. If your business is deemed high risk by any of these companies, your account will likely be suspended without notice. Some high risk industries are suspended for inherently violating certain terms of service or for receiving too many chargebacks. Follow these steps if your account was suspended by PayPal for being high risk.

How Does It Work?

Have you ever wondered how your funds are transferred from your bank to your merchant account? How your online money transaction is made secure or are you using a high-risk merchant account?

When you process a card transaction over a digital network, this network does not operate in isolation. Rather it works in close coordination with some processing center associated with the card, as well as the network related to back-end reconciliation. The mentioned networks get linked internally through a unique identification code and a gateway.

Whether you are a physical material supplier or an e-commerce seller, you will have a unique Merchant ID (MID) to carry out your monetary transactions. It is a simple code but an extremely important one. Do you know where to find your merchant ID number? If not, this article is the perfect place to find it. Here is a brief account of what Merchant ID is and how to find yours.

Beware of Fraudsters: Do not share your Merchant ID

Your MID is your personal identification code associated with your bank accounts. If this code gets in the hands of a fraudster, it could be used to make illegal transactions. Thus, it is important that you keep your MID private and secure. In case you change your credit card processor, you will receive a new Merchant ID for that and you will have to make note of it. Make notes of everything you can at all times because now you’re an entrepreneur which means you have to be on the ball at all times.

If you find yourself giving away your information often.

How to find your Merchant ID

Merchant IDs are not available publicly and you cannot search for them online. Instead, this private information is available on your credit card documentation. Following are the multiple ways to identify your Merchant ID number.

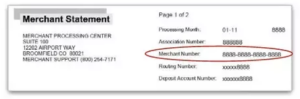

#1: It is a 15-digits long code on the upper right corner of your monthly merchant statement.

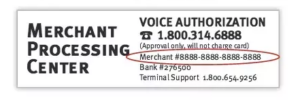

#2: Your Merchant ID is also present on the sticker of your credit card terminal as shown in the example below:

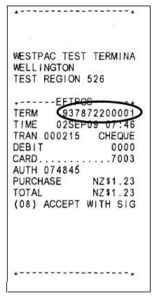

#3: Lastly, you can find MID on your credit card transaction receipt. Please refer below example for better illustration of this:

Safety and security are of utmost importance during the transfer of your payments, especially in online transactions which are high-risk merchant accounts. To ensure this safety at your end, it is necessary for you to understand the basics of merchant ID and ways to identify it. This will not only ensure the security of your funds but also help you in post-processing documentations.

In a nutshell, MID is a distinct number that is connected to your merchant account. It is used to identify your merchant account during payment transactions, adjustments, reconciliations, monthly fees, etc. You can find your MID number on any of the following three places: either on the top right of your monthly merchant statement, on the sticker on your credit card, or your credit card transaction receipt. Once you figure it out make sure to keep your Merchant ID private during business communications.

Sources:

1 – Elon Musk Says The Human Brain Cannot Cope With Business Failure. Is He Right?

No Comments

Sorry, the comment form is closed at this time.