Electronic Check Verification: How to Verify Funds on a Check

Electronic Check Verification: How to Verify Funds on a Check

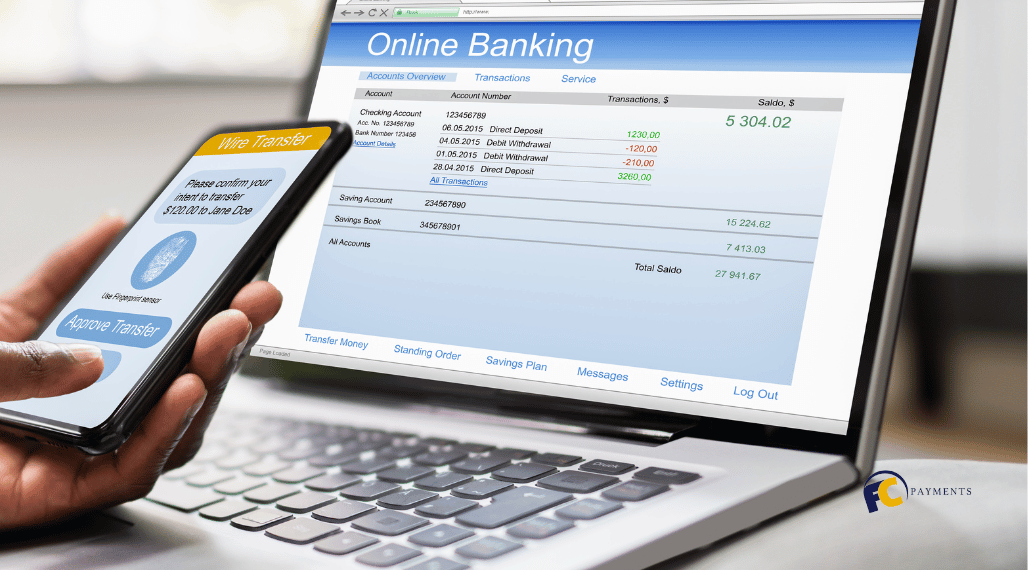

Imagine a world where you could verify a check’s validity and ensure that the funds are available within minutes, all from the comfort of your home or office. That world is here thanks to the power of electronic check verification. As a business owner or individual, you might have encountered situations where a check bounced or turned out to be fraudulent, leading to financial losses and headaches. In this blog post, we’ll explore different methods of verifying checks online, the importance of check verification, and how to verify a check online for free.

We’ll also discuss alternative methods for check verification, tips for spotting fake checks, and the benefits of electronic check verification. By the end of this post, you’ll have a comprehensive understanding of check verification and how it can protect you and your business from financial risks, as well as how to verify a check online for free.

Quick Summary

- Verifying a check online is not always free, but banks and third-party services may offer the service for a fee.

- It is essential to verify checks before accepting them in order to protect against check fraud risks that can lead to financial loss.

- Electronic Check Verification offers faster processing times, enhanced security features, and minimized risk of fraud with added protection for sensitive information.

Is It Possible to Verify a Check Online for Free?

While the idea of verifying a check online for free is enticing, it’s not always possible. Some banks and credit unions may offer free check verification services, but policies vary, and not all banks provide this information over the phone or online.

Third-party check verification services may also be an option, but they often charge fees for their services. So, while it might not always be free, there are still ways to verify checks online or through alternative methods to protect yourself from potential fraud and financial losses.

Bank or credit union options

Banks and credit unions may provide check verification services, but keep in mind that their policies vary. Some financial institutions may confirm the legitimacy of the bank account and routing number but might not be willing to verify the check funds, especially over the phone. In these cases, in-person verification may be required to obtain that information.

So, while it’s not always a guarantee that you can verify a check online for free through your bank or credit union, it’s still an option worth exploring.

Third-party check verification services

Another option to verify checks is through third-party check verification services. These companies specialize in helping businesses and individuals verify checks, but they often charge fees for their services. Typical charges range from $0.15 to $0.25 per transaction, with monthly statement fees ranging from $20 to $50 per month.

While not always free, utilizing third-party check verification services can help you ensure the validity of a check and mitigate the risk of fraud and bounced checks.

The Importance of Check Verification

Check verification is a crucial step in any transaction involving a check, as it helps to:

- Confirm the customer’s checking account

- Ensure the availability of funds

- Ultimately prevent check scams, fraud, and financial consequences associated with returned checks

Whether you’re a business owner dealing with numerous checks daily or an individual accepting a check for a one-time transaction, verifying the check before depositing it can save you a lot of trouble and potential financial loss.

Verifying a check is a simple process that can be done in a few steps. First, a few things.

Check scams and fraud risks

Check scams and fraud risks are real threats that can lead to significant financial losses for individuals and businesses alike. Common check scams include inheritance or lottery winnings scams, where recipients are informed they’ve received an inheritance or won the lottery but are required to pay taxes or fees before receiving the funds.

Accepting a counterfeit check could result in substantial financial losses, and if a check from a scammer is cashed, you’ll be responsible for reimbursing the full amount of the check. That’s why it’s essential to verify checks before accepting them.

Bounced checks and financial consequences

Failing to verify a check before depositing it can lead to bounced checks, which come with their own set of financial consequences. Bounced checks can result in fees from both your bank and the issuer’s bank, as well as possible damage to your credit score.

By verifying funds in a check before depositing it, you can ensure that the funds are available in the customer’s checking account prior and avoid the financial repercussions of a returned check.

Step-by-Step Guide to Verifying a Check Online

A step-by-step guide to verifying a check online can be broken down into two main methods: contacting the issuing bank or credit union and utilizing third-party check verification services. Both options have their advantages and limitations, and it’s important to weigh these factors when deciding which method to use.

By following the steps outlined in this guide, you can confidently verify checks online and protect yourself from financial risks.

Contacting the issuing bank or credit union

To verify a check by contacting the issuing bank or credit union, follow these steps:

- Start by searching the bank’s website for their customer service phone number.

- When you call, you can inquire about the bank account status, but keep in mind that not all banks may provide this information over the phone.

- In some cases, they may only be able to confirm if the account exists.

If funds cannot be verified over the phone, you can take the check to a branch of the issuing bank for added caution. This may enable you to cash the check without depositing it, eliminating the risk of the check bouncing. Although this method may require more effort on your part, it can provide peace of mind knowing that the check is legitimate and the funds are available.

Utilizing third-party check verification services

Third-party check verification services are another option for verifying checks online. These companies specialize in assisting with check verification by examining the payer’s financial history and confirming the availability of funds. However, some third-party check verification services may charge fees for their services, so it’s essential to research the costs associated with using these services before deciding to utilize them.

By using third-party check verification services, including a reliable check verification service, you can streamline the process and have added confidence in the check’s validity.

In-Person and Over-the-Phone Check Verification Alternatives

While online check verification methods are convenient, there are also in-person and over-the-phone alternatives for those who prefer a more traditional approach or face limitations with online services. These methods include visiting a financial institution or calling customer service agents to verify checks.

Explore as many options as possible so you can find the one that suits your needs.

Visiting a financial institution

Verifying a check in-person at a financial institution is a reliable method to ensure the check’s legitimacy. To do this, simply bring the check to a branch of the issuing bank, along with the necessary information, such as the routing and account numbers and the amount of the check. The bank may be able to inform you of the check’s authenticity, confirm that the account holder has sufficient funds available, and guarantee that the check will not be returned unpaid.

The typical duration of an in-person check verification process is approximately two business days. Although this method may require more time and effort compared to online verification, it provides a higher level of certainty that the check is legitimate and the funds are available. This can help you avoid potential financial losses associated with check scams and bounced checks.

Calling customer service agents

Another alternative to online check verification is calling a customer service agent at the issuing bank to verify a check over the phone. When doing so, have the check on hand to accurately provide the necessary information, such as the account holder’s name, the amount of the check, and the date it was issued.

However, be aware that some banks may not release information over the phone due to security considerations or technical limitations. In these cases, you may need to consider other methods, such as in-person verification or third-party services.

Tips for Spotting Fake Checks and Avoiding Fraud

To protect yourself and your business from check fraud, it’s crucial to be vigilant in spotting fake checks and avoiding potential scams. By carefully inspecting check details, such as routing and account numbers, and verifying account holder information, you can significantly reduce the risk of falling victim to check scams.

In the following sections, we’ll provide tips for identifying fraudulent checks and ensuring the authenticity of the checks you receive.

Inspecting check details

One of the first steps in identifying a fake check is to thoroughly inspect the check’s details. This includes examining the routing and account numbers, the check number, and the signature for any irregularities or discrepancies.

By paying close attention to these details, you can more easily spot fake checks and avoid potential financial losses associated with check fraud.

Verifying account holder information

In addition to inspecting check details, it’s essential to verify the account holder’s information to confirm the check’s authenticity. This can be done by contacting the issuing bank or credit union and providing the necessary information, such as the account holder’s name and account number.

By verifying account holder information, you can further reduce the risk of check fraud and ensure that the check you receive is legitimate.

Benefits of Electronic Check Verification

Electronic check verification offers numerous benefits compared to traditional methods of check verification, such as faster processing times and enhanced security features. By utilizing electronic check verification, you can expedite the check verification process, minimize the risk of check fraud, and protect your business from potential financial losses.

In the next sections, we’ll explore the advantages of electronic check verification in more detail.

Faster processing times

One of the primary benefits of electronic check verification is its faster processing times. Quicker processing times with electronic check verification offer several advantages, such as:

- Expedited NSF notification

- Effective check processing

- Accelerated cash flow

- Decreased processing fees

- Diminished mailing costs

Faster processing times also help to decrease the chances of fraud, providing you with more reliable check verification results.

Enhanced security features

Electronic check verification includes enhanced security features, such as:

- Authentication

- Public key cryptography

- Digital signatures

- Encryption

- Advanced encryption technology

These security features provide added protection for your sensitive information and reduce the risk of it falling into the wrong hands.

With the increased security provided by electronic check verification, you can have greater confidence in the checks you accept, helping to protect your business from check fraud.

First Card Payments

First Card Payments is a high risk merchant service provider that offers check verification services, helping businesses prevent fraud and streamline payment processing. With a merchant account from First Card Payments, you can:

- Securely accept eChecks and other forms of payment with minimal risk

- Enjoy the benefits of faster processing times

- Take advantage of enhanced security features

By partnering with First Card Payments, you can take advantage of their check verification services to:

- Protect your business from potential check scams and bounced checks

- Move away from traditional lockbox payment methods that may be susceptible to fraud or accidental threats

- Ensure that your business can continue to thrive and prosper without the constant worry of check fraud.

Full Summary

Check verification is an essential step in any transaction involving a check. By verifying checks online through bank or credit union options or third-party services, you can protect yourself and your business from check scams, fraud, and financial consequences associated with bounced checks. Electronic check verification offers additional benefits, such as faster processing times and enhanced security features, helping to further safeguard your financial interests.

By following the tips and guidelines provided in this blog post, you can confidently navigate the world of check verification and ensure the authenticity of the checks you receive. Stay vigilant, explore your options, and protect your business from potential financial risks associated with check fraud.

Frequently Asked Questions

How can I verify if a check is real?

To verify if a check is real, feel the paper for thickness and check for a matte finish.

To test the ink, run your finger across inked areas of the check – if it smears, it’s fake.

How are checks verified?

Checks are verified by contacting your bank, your customer’s bank, or a third-party check verification service.

To ensure accuracy, make sure you use legitimate sources when verifying check funds.

Can I verify a check online for free?

It is possible to verify a check online for free, depending on the bank or credit union you use.

However, third-party services may charge fees for their services.

What are some tips for spotting fake checks?

Examine the details on the check, such as the routing and account numbers, and verify the account holder’s information to spot fake checks.

Additionally, inspect for any discrepancies or signs of tampering on the physical check.

What are the benefits of using a merchant service provider like First Card Payments for check verification?

First Card Payments offers enhanced security features, faster processing times, and fraud prevention services to help streamline payment processing for businesses.

These features make it easier for businesses to accept payments securely and quickly, reducing the risk of fraud and increasing customer satisfaction.

The company also provides a range of customer support services, including 24/7 customer support.

My interest in the financial world started to blossom in High School. However, my parents tell me I use to watch financial programs before the age of 5. So, I guess I was born with the Financial bug. In high school I was accepted into their Finance Academy, which I attended for 4 years. In addition to graduating high school, I accumulated a substantial amount of financial knowledge few people experience at such a young age. During which time, I won the State of Florida Stock Market Contest and I also finished in the top 100 in the CNBC stock market contest which had over 1 million participants throughout the country (including some of Wall Street’s elites) with a take home prize of $1 million. These achievements allowed me to be invited to many shows and events with top people in their fields of business from around the world.

No Comments

Sorry, the comment form is closed at this time.